Introduction to The New Show

Welcome to Simply Real Estate w/ Todd C. Slater. It’s being recorded right here in the head office of The Simple Investor. Well… one of the reasons we’ve decided that we should start doing a video blog again was the fact that the world keeps changing in the wonderful world of Real Estate, and we want to keep everybody informed week to week.

Now some of you may tune in to our Real Estate show on Newstalk 1010, Simply Real Estate. It’s done on Saturdays at 3 pm, or you can go to our SoundCloud so you can catch some of our previous shows. But we thought it would be better for us to actually see each other… or at least, you get to see Todd and hopefully, one day, we will see you here at The Simple Investor.

What You Can Expect

Now, Real Estate Investment is one of the huge topics that we’ll be talking about here on a regular basis, but we’ll also have a lot of conversations about the market itself: “What is happening in the world of Real Estate?”

And we’re not just going to keep it limited to the Greater Toronto Area.

We’re going to talk about the provincial impact, the national impact, and the big world of Real Estate, as well. That means, in the United States, in Europe, and of course, other places that have some kind of effect in the Real Estate market.

- “Where are the markets going?”

- “Where is financing going?”

- “Where are interest rates going?”

These are some of the topics that we’ll be talking about on a weekly basis, and of course, the impact it’s going to have on you as both a buyer and seller.

But starting off with the basics, the thing we are going to break down this week is:

What is a Real Estate Investor?

Some people think its merely hopping into the market, making a few bucks from capital appreciation, and then turning around and selling. That doesn’t make you a Real Estate Investor…

Actually, a Real Estate Investor is somebody that holds Real Estate.

And if we go back in time, when people are called landlords being, originally, the lord of the land, they held on to their land. This is one of the things we need to talk about.

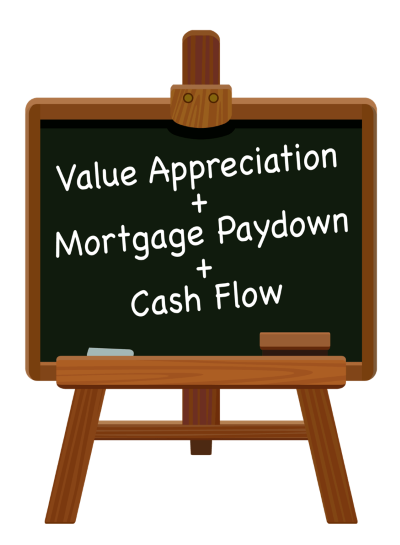

So, let’s break down what a Real Estate Investor truly is, and the most important thing they’re going to use is what we call The Simple Equation.

The Simple Equation

There are three main factors in The Simple Equation of Real Estate Investment:

Equity Appreciation

Let’s start off with that equity appreciation, the value increase. The one where we see so many markets go up and down. It’s that see-saw battle.

As an investor, you need to know: is your market, right now, experiencing an increase in value, or is it actually leveled off or going down?

The funny thing about value appreciation is that your tenant doesn’t care! In fact, your tenant’s rent doesn’t change based on the value of your property.

But the number one thing we should mention when talking about equity appreciation is the fact that when values go up like if you buy something for $100,000 maybe next year it’s worth $105,000, well that’s you getting money in your pocket. But you’re not going to tap it quite yet, we’re going to let this ride for a long period of time.

We always talk about the importance of timing. As time goes on your values will creep up. Historically if we talk about places like Canada and the United States, Real Estate normally has an increase between 4% and 5% annually for the last 50 years. So that’s a pretty good number to aim for.

Mortgage Paydown

The next thing we’re going to focus on, of course, is going to be mortgage paydown. Now, if you’ve done your job right and you’ve got the right tenant in place that pays the rent every month, guess what? Your tenant is paying for your mortgage.

When you make that mortgage payment, you are paying interest, of course. That’s a big part of the actual payment, but there is the actual paydown of that mortgage, as well.

If we calculate it out correctly, we’re normally looking at a 3% of the actual mortgage being paid down on an annual basis.

Equity Differential

Now, keep in mind. With the value appreciation and the mortgage paydown, that starts to add up when we take a look at the return column, and one of the things that you’re doing is creating equity differential. Your value is going up. Your debt is going down!

Cash Flow

The last thing, obviously, in the equation is cash flow. If you’ve bought in a high market that’s been appreciating like crazy, your cash flow normally gets into a negative. In other words, values have gone up so much but rent has not.

And when we take a look right across the world, this has happened for the last ten years. We don’t see the value-rent ratio being kept even. So, a lot of people are actually experiencing a large negative cash flow.

But why buy then? Well, that’s when we start talking about speculation, not investing. We’re hoping for that equity increase in the market place.

There are good reasons people might choose speculation instead of investment, but we’re not going to talk about it this week. In fact, that’s the topic we’re saving for next week. That’s going to make you a Simple Speculator.

When we talk about speculation, of course, there are all sorts of factors, and we’re going to break it down for you in our next episode! We’re going to try to keep these segments short and sweet so we don’t keep you away from important time with your family.

If you have any questions or are unsure about anything we covered this week, you can book a phone meeting or in-person meeting with Todd below, and he would be glad to help you out.

Subscribe to our youtube channel to be notified when the next episode is released. It’s definitely going to be an episode you won’t want to miss.